Best Time Ever: Foreign Investment of ABS in PRC

Back in 2009, it was utterly difficult for any Chinese financiers to even think of issuing large-scale asset-backed securities (ABS), given that the China Banking Regulatory Commission (CBRC) just called the credit-asset securitization pilot off as a result of the international financial crisis in 2008. Generally speaking, asset-backed securitization refers to the business activity of issuing securities backed by real assets or cash flow generated by some underlying real assets or financial portfolios. These securities are independent of the relationships of the original equity holders, managers, trustees, investors and other business participants involved. Despite all the advantages of asset-backed securitization such as lower financing costs, more flexible use of funds and even providing liquidity to the remaining assets, there were few new asset-backed securities issued over the years in China until circumstances changed in 2014.

I . Booming Growth of ABS Market in PRC

On November 21st of 2014, the China Securities Regulatory Commission (CSRC) promulgated the Regulations on the Management of Asset-backed Securitization Business of Securities Companies and Fund Management Company Subsidiaries (hereinafter referred to as the “2014 Rule”) and the supporting rules relevant thereto. Compared to the previous business management regulations, the 2014 Rule stipulates that CSRC will cease to examine or approve the asset-backed securitization projects in detail while, instead, the stock exchange shall be responsible for demonstrating the feasibility of each listing. Moreover, each case shall be filed with the Asset Management Association of China (AMAC) after the issuance is accomplished. Therefore, the issuance and effective time of asset-backed securitization will be significantly reduced.

Since the resumption of asset securitization in 2012, enterprises have so far issued RMB 2,532.115 billion yuan of asset-backed securitization products. The issuance of RMB 956.405 billion yuan in 2018 is regarded as the grand occasion as it set a new record, eclipsing the previous record of 834 billion yuan in 2017.

According to CNABS data on January 21st 2019, there were 943 new ABS products issued in 2018 with a total of RMB 20.6 billion yuan, scoring growth rates of 46.13% and 40.44% respectively. Furthermore, 156 new issues occurred in the credit ABS market at a total of RMB 932.3 billion yuan, 691 new issues in the enterprise ABS market at RMB 950.2 billion yuan; and 96 new issues in the ABN market at RMB 126.1 billion yuan.

“In today’s trading market, factor financing, CMBS, and REITs must be the most coveted asset types which are growing over time, following by lease financing, accounts receivables, and fee income rights”, said Lin Hua, chairman of CNABS Operator and Shanghai Heyi Financial Information Service Co., Ltd. He expected that personal consumption loans and factor financing would be the largest asset types in 2019 ABS market in line with their scale of monthly repayments among the various asset types nowadays.

Of the 900-billion issuance of credit ABS, the top three categories were housing mortgage loans (54 cases, RMB 584.3 billion yuan), automobile mortgage loans (29 cases, RMB 122.1 billion yuan) and enterprise loans (20 cases, RMB 98.1 billion yuan). In addition, credit card installment products grew so rapidly that 7 asset-backed securities with a total amount of RMB 63.5 billion yuan were issued in 2018. Among the 691 ABS products in the enterprises ABS market, the largest were: 92 individual consumer loans at RMB 193.261 billion yuan; 99 receivables at RMB 176.686 billion yuan; 217 factor financing at RMB 145.309 billion yuan.

Given the support of favorable policies and laws in China, it doesn’t seem the current prosperity of ABS would be a flash in the pan.

II. Favorable Legislation and Policy for Foreign Investors

In July 2017, the inaugural launch of the long-awaited Bond Connect scheme marked yet another significant breakthrough in China’s capital market development along with MSCI’s recent announcement of China A-Shares inclusion in its Emerging Markets Index and other major global indices in 2017, coincided with the twentieth anniversary celebration of the formal establishment of the Hong Kong Special Administrative Region (“Hong Kong SAR”).

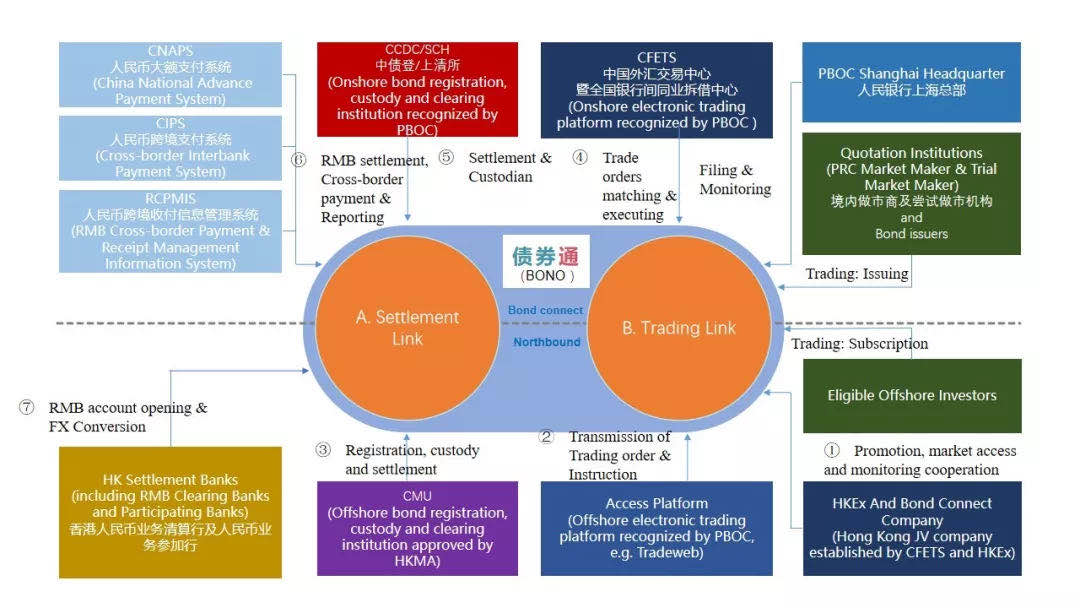

Bond Connect, a device both for offshore investors to access the mainland China bond market (“Northbound Trading”) and for onshore investors to access the Hong Kong bond market (“Southbound Trading”), serves as the linkage between the mainland China and Hong Kong SAR.

The total trading volume of Bond Connect rose dramatically reaching RMB 74.3 billion in November 2018, with an average daily turnover of RMB 3.38 billion, according to BCCL data. It’s reach has since expanded into 23 jurisdictions and 467 international institutional investors across the globe, with a total of 450 international institutional investors joined.

(Diagram from KWM|Building the Greater Bay Area into a Financial Hub)

It is likely that spot trading of all bonds that are currently traded in the CIBM are executed by eligible offshore investors under Northbound Trading, including but not limited to sovereign bonds, local-government debts, central bank bonds, financial bonds, corporate credit bonds, inter-bank deposit receipts and asset-backed securities. Based on published rules, the access to the primary and secondary bond markets will be granted to eligible offshore investors through Northbound Trading. Furthermore, there is no investment quota limit for Northbound Trading. Although exciting, it is not the end of the bull market news. On the evening of January 31st 2019, the Draft Regulation for the Administration of Domestic Securities and Futures Investment by Qualified Foreign Institutional Investors and Renminbi Qualified Foreign Institutional Investors was released by the CSRC, pursuing further extension of capital market deregulation and attracting more long-term overseas funds.

This draft manages to combine both systems of QFII and RQFII. Under QFII rules, foreign institutional investors are required to apply for the qualification once and for all. Meanwhile, for those institutions in countries and regions that have not yet obtained RQFII quota, their funds are allowed to be maintained and invested in foreign currencies. Essentially this revision simplifies the requirements of application documentation and shortens the time required for examination and approval.

III. Significant Foreign Success in 2018

Recently, BC Capital Group Limited (hereinafter referred to as “BC Capital”) joined force with OCI International Holdings Limited (00329.HK, “OCI International”) to launch thenew BC Greater China Opportunities Fund SPC - OCI BC Fixed Income Fund SP successfully, which is committed to investing in asset-backed securitization products such as ABN and ABS of domestic banks and listed in exchanges through Bond Connect and RQFII channels.

Fund managers are actively looking for high-quality asset targets in order to tap the potential of portfolio optimization and devote themselves to goal of combining asset security and return so that sustained and steady returns could be brought to investors. The target size of the fund is US$500 million, and the start-up fund has already reached tens of millions of dollars’ subscription.

Nonetheless, significant foreign access could be traced back to 2017 when the first asset-backed securities, Fuyuan's personal automobile mortgage loan backed securities (hereinafter referred to as "Fuyuan 2017-2"), introduced foreign investors to the interbank bond market through Bond Connect (Northbound Trading). Ford Automobile Finance (China) Co., Ltd. is the issuer of Fuyuan 2017-2 along with its parent company Ford Automobile Credit Co., Ltd. (USA).

It is well-known to us that Ford Automobile Finance (China) Co., Ltd. has been operating personal automobile mortgage loans in China for 12 years. By the end of June 2017, the total assets of Ford Automobile Finance (China) Co., Ltd. had reached 39.240 billion yuan. Of course, Ford Automobile Credit Co., Ltd. (USA), which is one of the largest companies of securitization of accounts receivable for automobile in the world, has been involved in asset-backed securitization since 1988. At last count, Ford Motor Credit Co., Ltd. (USA) maintains many subsidiaries in the United States, Canada, Europe and China and has, without any doubt, a high brand awareness in the world and recognition by overseas investors.

IV. Tight Corner Remains

Hardship of Enforcement of Investors’ Rights

To begin with, how does an eligible offshore investor enforce its rights in CIBM bonds invested through Bond Connect?

It was indicated by PBOC in a recent press conference that there could be two choices for an eligible offshore investor that the investors may enforce their rights, either through HKMA/CMU or in its own name in accordance with applicable laws in Hong Kong. The SCH Rules expressly stipulate that eligible investors “enjoy the rights and interests of the [bonds] according to applicable laws.” Hong Kong law recognizes that investors who hold beneficial interest in bonds acquired for them by their custodian (i.e. CMU members and HKMA). While the laws and regulations of Hong Kong SAR empower the eligible offshore investors, as beneficial owners of the bonds, to exercise their rights in CIBM bonds with reference to nominee holding and custody arrangements.

Under PRC law, the plaintiff to a legal claim is any citizen, legal person or any other organization with a direct interest in the claim. As long as an eligible offshore investor providing evidence that it is the ultimate beneficial owner of the relevant CIBM bonds (i.e. certificate/proof showing that such eligible offshore investor is the legitimate beneficial owner under Hong Kong law), the offshore investor should be entitled to bring a legal claim in its own name in the PRC courts.

Hazard of Violation of Rules and Regulations

The next question would be what the consequences are if an eligible offshore investor is found to have contravened the relevant Bond Connect rules and regulations.

An investigation could be initiated by CFETS upon finding any actual or potential breach by eligible offshore investors under the Bond Connect trading rules and/or other rules and regulations relating to the CIBM. Pursuant to the rules published by CFETS, it has close surveillance over certain abnormal bond transactions under Northbound Trading. For instance, repeated sending of quotations that do not reflect genuine trading intention, responses of tradable prices or settlement prices that significantly deviate from fair market value, and market disruption activities including market manipulation and insider trading, etc.

Limitation with Approach of Bond Investments and Information

Despite these improvements, qualified foreign investors are still plagued by restrictions on their bond investments in China. Overseas, ABS issuance are usually public offerings, and are thus enjoying liquidity. In China, however, ABS are usually private offerings, the products can only be issued to specific private parties, and therefore information of ABS products are not sufficiently transparent. In many cases, investors have no resources to find out the interest rates of certain ABS products as well as the circumstances of their payment obligations.

CNABS and ABS Cloud, two platforms that have been struggling hard to provide fundamental information, including but not limited to underlying assets and repayment frequency, of ABS transactions in China. Although these unofficial platforms do help foreign investors to acquire the essential information of China ABS products, their information, however, are often vague, largely derived from the communications between private entities, banks, and real estate companies, such information do not lend themselves to much credibility, unfortunately. Moreover, CNABS has also cooperated with Moody's which acknowledges the information it provides. On a positive note, we may see several large domestic institutions reaching out to the CSRC, seeking official disclosure qualifications.

Lack of Liquidity and Withdrawal Mechanism

At present China’s ABS products are suffering from illiquidity. ABS products in China typically have few sellers, They may be listed in stock exchanges or CIBM,but it is quite common for participants to hold it to maturity since lockup period is usually three years. As a result, the domestic ABS market is in need of improving entry and exit mechanisms.

Extra Cost on Swaps and Commission Fees

For foreign investors, exchange rate risk is another barrier. Securing inbound overseas funds still requires the purchase of interest rate swaps in order to lock in and reduce foreign exchange risk. These exchange rate products have to be purchased separately, thus increasing investor’s capital cost, not to mention the high management fees of QFII and RQFII.

V. Opportunities Emerge

Summing up, even taking into account all the barriers aforementioned into consideration, opportunities for qualified foreign institutional investors to invest in China’s ASB markets are still abound and growing every day.

Foreign investment in China's bonds accounts for about 2.52% of the bond markets in mainland China and 3.93% of the sovereign bonds market, much lower than those in Japan, the United States and even some emerging markets.

With more favorable legislations and policies by the government, and the rapid growth of the domestic ABS market, it is safe to conclude that now is the perfect moment for foreign investors to gain access here in Mainland China.

相关研究

-

11-052020

工程量清单项目特征描述不准确导致的争议及规避措施

工程量清单项目的特征决定了工程实体的实质内容,直接决定了工程实体的自身价值(价格),应予以详细而准确的表述和说明。 -

05-292020

企业赴美上市指南

美国的资本市场是以投资人选择为导向,以注册制为原则,赴美上市成功的关键在于企业的基本面和投资人的认可。 -

10-292020

《民法典》《九民纪要》下合同不成立、无效、被撤销或确定不发生效力的情形和法律后果简析

本文重点参考《<民法典>理解与适用》及《<九民纪要>理解与适用》中的观点,并简析《民法典》《九民纪要》下,合同不成立、无效、被撤销或确定不发生效力的情形和法律后果。 -

04-222020

建设工程项目部印章对合同效力的影响及使用时的注意事项

本文将对盖章行为不规范引起的合同效力问题进行分析,主要讨论盖章主体没有权限以及使用未经备案公章盖章的行为效力。 -

08-192020

重磅新规整理 |《公安机关办理刑事案件程序规定》新旧条文全文对照表

《公安机关办理刑事案件程序规定》新旧条文对照表,由汉盛律师事务所裴长利律师、吴承栩律师、实习生史亮亮整理校对,谨供一线刑事法律工作者参考学习。

沪公网安备 31011502009353号

沪公网安备 31011502009353号